You’ve probably got many reasons for wanting to work abroad: a change of scene, a desire for adventure, a better climate, or looking for the highest standards of living or career growth.

One reason many of us look for work in a new country is the ability to make more money than we can back in our home country. Economic growth in these countries often drives higher wages and better career opportunities. So, here’s a list of the best countries to earn money.

The best countries for high take-home after-tax income for high-level earners are the ones that don’t impose additional tax rates on the highest incomes. Additional tax rates do not impact mid-level earners as their income doesn’t usually fall into the highest brackets. As a result, each country’s ranking is different for high and mid-level positions.

Secure Peace of Mind with Best-Value International Health Coverage

International Citizens Insurance provide free, no-obligation quotes from the leading international health insurance providers with plans tailored to meet your needs. Trusted by thousands of expats worldwide.

1. The United Arab Emirates and Switzerland

The UAE for high-level positions

Regarding after-tax income, the United Arab Emirates with Dubai, the World’s expat capital city, is a clear winner. Expats receive high salaries in Dubai as tax-free income, as there’s no income tax in the emirates.

The UAE and Dubai, in particular, pay the highest salaries to professional expats.

Executive-level professionals relocated by their company take home, on average, €285,000 annually. In 2024, the hottest field for C-level professionals is IT: Chief Information Officer (CIO), Chief Technology Officer (CTO), and Chief Information Security Officer (CISO) are in high demand and pay higher wages than elsewhere, according to a report released by recruitment consultancy Robert Half.

If you are a contractor or an independent job seeker, the UAE is a great option for building wealth and a career. Engineering (IT, energy, construction, science, etc.), sales, finance, and healthcare are the leading industries hiring expats.

For example, a Senior Consultant Doctor can earn over €26,000 a month plus all the perks such as relocation assistance and company pension.

The average daily rates for independent contractors in engineering are over €900, and for sales and business development, they are €670.

Our complete guide to Living In Dubai will help you discover more about Dubai’s opportunities for expats. Our guide on the Dubai laws and rules can help you understand more about lifestyle changes if you opt for the UAE.

Switzerland for mid-level positions

If you are a mid-level professional being relocated by your company to Switzerland, you just hit the lucky pot. You can count on the average annual salary of €119,000 after tax, reflecting the high per capita disposable income contributing to the country's high living standards and financial security.

Permanent employment in software engineering fields can bring you around €100,000 before tax a year for a mid-level position if you have a specific set of skills required by the employer.

After-tax numbers depend on which territory you reside in. If you live in Zurich, you will take home around €76,000 a year after tax.

The average annual salary for accountants in Switzerland stands at €95,000 Euro. A senior accountant can earn substantially more depending on experience and any specialist sector skills.

Switzerland is a great destination for independent contractors in the sought-after fields. For example, a mid-level developer with four years of experience can earn €500-800 pre-tax daily.

The daily rates for mid-level managerial and consultancy contracts are €300-500.

If you want to relocate to Switzerland, our guide to Moving To Switzerland is a great place to start your research.

2. Saudi Arabia and The UAE in the Middle East

Saudi Arabia for high-level positions

Saudi Arabia is the largest economy in the Middle East. Just like in the UAE, there is no personal income tax in this country, which is a significant financial advantage for expatriates. Skilled workers are in high demand, and an average expat’s top-level salary is about €280,000 a year.

Senior-level independent job seekers with an engineering background can earn from €150,000 to over €200,000 a year plus a relocation package. On average, project directors take home about €163,000 a year.

You can count on an average of €150,000 in a legal department. Sales and business development executives take home an average of €125,000, and executive managers - €120,000.

Finance directors and CFOs can expect an average of €150,000 and over.

International lawyers and HR directors command the highest average salaries.

The UAE for mid-level positions

On average, companies relocating their mid-level staff to the UAE offer €108,000 annually.

Law, finance and accounting, oil and gas, IT, and real estate pay the highest average salaries in the UAE.

Mid-level IT specialists with 4-6 years of experience can expect a salary of €85,000 annually.

The average accountant salary in UAE stands at €25,000

Independent contractors in in-demand fields such as engineering can expect around €240 a day.

The low-tax lifestyle in the UAE enables residents to preserve more of their earnings and save money.

Looking for a job in Dubai? Read this first: Working In Dubai – How to Find A Good Job In The UAE.

3. Hong Kong and Saudi Arabia

Hong Kong for high-level positions

Hong Kong consistently ranks well in terms of expat earnings, with an average value of a typical executive salary package of €270,000 after tax. The high per capita disposable income in Hong Kong reflects its high living standards and financial security.

Are you looking for a job in the banking and finance sector? You can count on an average of €250,000 a year, which will be reduced to €232,000 after tax.

One of the largest employment sectors for expats in Hong Kong is finance.

Almost all the highest-paying employers are banks and financial institutions such as Brookfield Investment Management, Goldman Sachs Capital Partners, Jefferies, CIMB, Commerzbank, and Takeda.

In the IT sector, a senior engineering manager can earn up to €215,000 a year (€201,000 after tax), and a senior DevOps manager - up to €235,000 (€219,000 after tax).

One of the highest paying positions is Chief Information Security Officer; a highly skilled and experienced senior CISO can earn over €300,000 a year (€275,000 after tax).

Positions of Chief Marketing Officer, Head of Sales, Head of Marketing, Head of Technology, and Legal Counsel are also very lucrative.

Saudi Arabia for mid-level positions

Are you being offered relocation to Saudi Arabia by your company? You can expect an average of €98,000 a year.

Independent job seekers in engineering can expect around the same, with petroleum engineers receiving the highest rates.

Marketing mid-level specialists are also in demand, but the offered pay is lower.

Mid-level positions average around €50,000 yearly, depending on your skills and experience. The same applies to Cyber Security, Data, HR, Sales, and IT.

4. Costa Rica and the USA

Costa Rica for high-level positions

On average, global companies relocating their senior staff to Costa Rica offer €260,000 annually after tax.

If you are looking for a job independently, senior-level CEOs earn, on average, €175,000.

Taxes are reasonably high, so expect to retain around €131,000 if employed and about €134,500 if you are a contractor and self-employed.

Getting a work permit or contract in Costa Rica requires a lot of effort.

You need to have a specific set of skills and experience. As usual, STEM, data analysis, AI, and marketing and communications need more skilled people in key positions.

You can find more information on expat life in Costa Rica, including residence, the cost of living, and where to live in our Living In Costa Rica guide.

The USA for mid-level positions

Relocated employees can expect around €97,000 (in U.S. dollars equivalent) a year after tax in the United States.

Mid-level professionals in highly sought-after areas looking for a freelance job can earn roughly the same as relocated employees, depending on their specific skills.

The most skill-starved areas in the USA are healthcare, IT, data, and finance, where mid-level specialists with specific skills can earn €90,000-€120,000 a year before tax. Expats working in the USA should be aware of their income tax obligations, as those from citizenship-based tax system countries must file their income taxes back home, while those from residential- or territorial-based countries only pay taxes if they reside or earn income in their home country.

The benefit of tax-free income in the UAE is significant for expats from these different tax systems.

US after-tax numbers depend on the state in which you reside.

For example, if you are single, work in San Francisco, and earn €120,000 a year, you will take home around €83,300 after tax, while Miami residents will take home €91,000.

Independent contractors’ rates vary depending on required skills, the companies hiring, and where the job is. The same jobs based in New York and San Francisco will pay different rates.

On average, mid-level front-end developers receive €100-€140 per hour before tax. Mid-level back-end developers - €120-€160.

Contracting engineers make €120,000 per year on average before tax.

Again, location plays a big role, with New York, Washington, California, New Hampshire, and Maine being the highest-paying areas.

Interested in relocating to the USA as a professional? To start planning your move, read our Living In The USA guide.

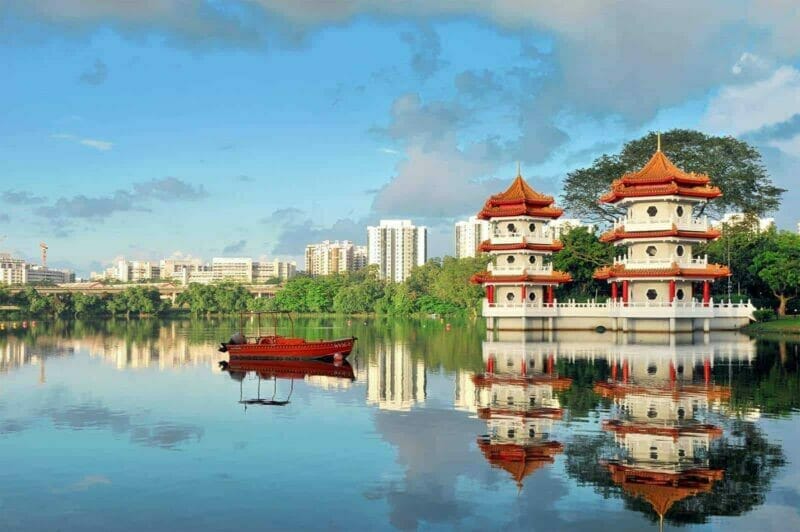

5. Singapore and Hong Kong

Singapore for high-level positions

On average, executives relocated by the company are paid €240,000 a year after tax.

Senior professionals in the finance sector looking for a freelance position can earn between €190,000 and €230,000.

C-suite positions in business services, chemicals, engineering, fast-moving consumer goods (FMCG), financial services, fintech, healthcare, and life sciences can earn as much as €360,000 a year before tax.

Senior positions in engineering can see a salary, for example, in the range of €180,000 - 210,000 a year.

Information and Communications, Finance and Insurance, and professional services are the highest-paying employers.

The high-level IT and software development contractors can earn around €400 per day.

Most Singapore expats will likely have to pay the progressive resident tax rates.

The income tax rate varies up to a maximum of 22%. If your gross salary is €210,000, you will take home €172,000 after tax. The importance of work-life balance in Singapore also plays a crucial role in attracting international talent.

Hong Kong for mid-level positions

For relocated specialists, an average salary is €96,000 after tax.

Independent mid-level job seekers with highly sought-after skills can expect to earn €70,000 - €90,000 a year (€80,000-€85,500 after tax).

Mid-level engineering managers, DevOps architects, infrastructure software engineers, business development managers, PR, and product marketers are at the top of the range.

6. Switzerland and Singapore

Switzerland for high-level positions

Exec staff relocated to Switzerland by the company are, on average, paid €190,000 a year after tax.

Independent job seekers at the C-suite level can expect good income, too.

On average, a Chief Financial Officer is paid around €193,000 a year, while a CEO's salary is north of €220,000 before tax.

Taxes in Switzerland can be a matter of discussion between the authorities and a prospective high-earning resident. Otherwise, a CEO living in Zurich earning €220,00 a year will have €146,500 after tax.

High-end consultant contractors can expect around €1500 a day.

Highly skilled IT contractors with specific skills can command €1000 and onwards a day before tax.

On average, contractors in management and change can expect €850 daily.

Singapore for mid-level positions

Mid-level staff relocated by the company can expect an average salary of €84,000 after tax.

Independent job seekers with mid-level expertise in sought-after fields should expect less after tax. However, it depends on their knowledge and experience.

A Market Development Manager, for example, can be offered around €120,000 a year, which is €97,000 after tax.

Lead Business Analyst and Market Analyst positions can pay around €99,000 yearly (€79,000 after tax).

At this level, you will likely find that jobs in Fintech will pay better than the same positions in big banks and traditional financial institutions.

The base salary range for a mid to senior full-stack Java developer is around €63,000-80,000 a year at a large bank and €67,000-98,000 at a large fintech.

For a product manager at the same level, it’s €75,000-84,000 for a bank and €84,000-98,000 for a fintech.

For a data analyst with one to three years of experience, banks budget €38,000-46,000, and fintech €50,000-67,000.

In addition to competitive salaries, Singapore's work-life balance policies, including vacation days and paid time off, contribute to a healthy work-life balance for professionals.

7. Thailand and Luxemburg

Thailand for high-level positions

High-end employees relocated by the company to Thailand are usually offered €175,000 a year after tax.

Independent job seekers in a C-suite range can count on an average of €150,000 pre-tax.

Finance directors with deep experience and the required skills can earn up to €170,000 (€161,500 after tax).

Experienced high-end sales and business development professionals can earn €150,000 (€142,400 after tax).

IT and software areas are relatively low-paying in Thailand.

However, an experienced software engineer with sought-after skills earns €115,000 and higher (109,000 after tax).

Management and Consulting pay well, with salaries on the high end reaching €141,500 and over (€134,400 after tax)

Luxemburg for mid-level positions

Professionals relocated to Luxemburg by their employer can enjoy an average of €83,000 after tax.

You can count on a good income if you seek work in financial services, insurance, or the science sector and have an in-demand set of skills and experience. Expats working in Luxemburg benefit from competitive salaries but must also be aware of their obligation to pay taxes based on their residency or income source.

Technical professionals and IT can earn up to €70,000 pre-tax annually.

A software architect with at least 5 years of experience can earn between €65,000 and €85,000 per year before tax.

Infrastructure and security architect - €80,000-€95,000.

Mid-level IT managers and CISOs can expect between €80,000 and €100,000 a year.

Good news for education specialists: according to OECD’s report, secondary school teachers’ salaries start at €73,700 annually.

Income tax and social security deductions impact your prospective salary substantially.

For example, if you earn $100,000 a year in gross salary, after tax, it is $71,393.

Independent contractors in software development with mid-level experience and specific skills can command €500-700 a day.

8. The USA and Japan

The USA for high-end positions

For professional expats in high-level positions, relocation to the USA can result in a benefits package of about €174,000 after tax a year.

In 2024, lucrative career paths like CEO, data scientist, cybersecurity specialist, healthcare professional, and technology executive will put you in the highest income groups in the USA and globally.

Are you looking for a job independently? If you are in the healthcare sector, you have the best opportunities.

High-end specialists in healthcare enjoy the highest incomes.

The median pay in this industry is €208,000 pre-tax, which means high-end specialists earn well above this figure.

For example, cardiologists and anesthesiologists can command over €300,000 a year before tax.

Moving away from healthcare, corporate chief executives are in the highest-paid profession, with an average pre-tax salary of €191,000 a year.

IT is another field with high salaries, yet a significant talent shortage exists.

Top Computer and Information Systems Managers earn € 189,000 on average before tax.

High-end independent IT contractors can command rates of €160 an hour and over, with lead developers pushing through €200 an hour.

If you are a high earner, taxes will decrease your earnings by a minimum of 25%, provided you reside in a state with no income tax, such as Florida.

So, if you live in Miami and earn €189,000 before tax, your after-tax income will be just over €140,000. In California, you will be taking home around €126,000.

Read our guides on Living in California and The Best Places To Live In Florida to see how the cost of living in these states can impact your wealth.

Japan for mid-level positions

Experienced expats still feel lukewarm about Japan. Although the country has changed its approach to foreigners, the perceptions take much longer to change. In contrast, South Korea has become increasingly attractive for expats due to its vibrant culture and growing job market.

Japan lags behind other Asian countries in terms of its perceived attractiveness to international workers.

However, for ambitious budding expats with a sought-after set of professional skills, it’s a great chance to start an international career and build up your wealth.

The average pay for middle managers relocated to Japan is about €70,000 annually after tax.

You should have at least some Japanese if you hunt for a job independently.

If you are a beginner, your best bet is multinational corporations in Japan or Gaishikei.

They tend to be more flexible. However, even here, better Japanese often means more accessible routes to higher-paying positions and more opportunities for career progression.

In global finance, business development, sales, investment banking, and wealth management, working for a multinational company at the mid-senior level, you can expect an income between €77,000 and €170,000 a year before tax, depending on your professional and language skills.

For example, a reputable Global Digital SEO/SEM consultant can earn up to €104,000 yearly pre-tax, resulting in around €77,000 after-tax income.

9. China and Denmark

China for high-end positions

Like many other countries worldwide, China desperately needs a skilled workforce, especially in IT, AI, and science. People with expertise in these areas are in huge demand.

The domestic job market cannot fill the vast number of advertised positions.

Specialists with over ten years of experience available for employment are a rare commodity, so Chinese companies are looking for such people worldwide.

A high-end level professional relocated to China by the company can expect an average pay of €170,000 after tax.

If you are an independent job seeker, international Chinese companies are the most attractive employers for you.

You bring your expertise plus the language of the targeted market, and they pay good money.

Analytics, business intelligence, sales, product management, marketing, data science, IT, and engineering are the highest-paying sectors.

A Managing Director of Analytics or a Marketing Director can earn up to €250,000 a year before tax.

An e-Commerce Director and Sales Director can expect to earn up to €270,000.

Moving to technology, CTOs can expect €350,000 and onwards, while application architects' salaries are around €245,000.

Taxes in China are progressive and reach 45% at the high level, so as a high earner, you will pay a lot to the taxman. A gross salary of €245,000 will provide €160,000 after tax.

Denmark for mid-level positions

On average, mid-level staff relocated to Denmark receive €68,000 a year after tax.

Are you seeking a job independently? An in-demand mid-level IT specialist can expect around €80,000 before tax.

Mid-level finance and investment sector positions can bring around €100,000 a year pre-tax, depending on your skills and expertise.

Marketing is also a significant sector, but you do need to be highly skilled and experienced to command a good salary. On average, mid-level marketing positions can pay €85,000 a year pre-tax.

If you are an expat employed by a Danish company, you can opt for an Expat Tax Scheme (ETS) with a flat tax rate of 32.84% on all income for up to 7 years.

However, you cannot use any tax allowances. Your average monthly salary must be a minimum of DKK 70,400 (just under €9,500).

Most expats in mid-level positions won't qualify for the ETS. Therefore, if your gross salary is €85,000 a year, depending on where you reside, you will take home €56,000-€57,000.

10. Peru and Australia

Peru for high-level positions

On average, companies relocating their high-level staff to Peru offer €162,000 after tax a year.

For independent job seekers, engineering, construction, marketing, global commerce, finance, and investment are the most lucrative areas.

An experienced C-suite level specialist with ten or more years of experience in these areas can expect a yearly pre-tax salary of €180,000 with international companies. This will result in around €153,000 after tax.

A CEO in gas, oil, and mining with specialist skills can expect €200,000 and higher before tax.

Australia for mid-level positions

If you are relocating to Australia with your company, you can earn up to €67,000 a year after tax.

There are ways to immigrate independently as a professional person.

Australia constantly looks for skilled people in certain professions, and the immigration procedures are straightforward.

Here is How to Find a Great Job in Australia and Get an Employer-Sponsored Visa. Just follow the plan, and you will succeed.

IT and cybersecurity are the most prominent sectors with skill shortages. Independent contractors in mid-level management positions with in-demand skills can earn around €400 a day.

A cyber security analyst based in Tasmania can charge between €300-€550 daily.

Your tax will depend on the total annual income and can be as high as 44%.

The same skill level full-time employee salary can reach €96,000 before tax. The income tax will take 29% off this sum. Additionally, people in Australia enjoy a great work-life balance, contributing to their excellent quality of life and overall happiness.

Other countries offering high salaries to professionals

Canada

Canada remains attractive financially for mid-level professionals. It is not such a significant destination for a work reassignment.

If your company relocates you as a mid-level manager, you can expect €62,000 before tax.

For independent job seekers who are highly skilled in most in-demand fields, immigrating to Canada through a skilled visa is easy. Check our How to Get a Canada Work Visa.

United Kingdom

The pre-tax salary in the UK for high-level staff relocated with their company is very attractive.

However, high earners get hit by higher (40%) and additional (45%) tax rates. The average after-tax income for high-level relocated staff is around €108,000 a year.

At the same time, mid-level positions can expect about €57,000 after tax.

Finance, IT, digital and science innovations, healthcare, and AI are sectors always looking for high-skilled talent.

A top contractor in these sectors can earn £900 a day before tax.

If you are interested in living in the United Kingdom, this is How To Get A Well-Paid Job And A Skilled Worker Visa In The UK.

After-tax income, disposable income, quality of life & cost of living factors

It's not just your after-tax income to consider when deciding which country is best for building wealth.

The living standards and cost of living are also important factors.

As a rule, employers in countries with the highest standards of living, which are more desirable, offer fewer perks, such as relocation packages and help with housing.

Conversely, countries with lower living standards offer better relocation packages and perks to global specialists to compensate for lower desirability.

Taxation is one of many factors in determining how much wealth you can build.

The critical factor is the cost of living. The high cost of living in countries with no income tax can significantly diminish your ability to grow your wealth as you have less disposable income to invest.

With the cost of living included, the UAE and Saudi Arabia slip to third and fourth place for high-level positions, and Costa Rica and Mexico take first and second.

So, when considering which country will benefit you financially, consider taxation and the cost of living in different countries.

The European job market, language skills and opportunities

Switzerland and Denmark are the only European countries in our top 10 ratings.

According to the Europe Language Jobs team, Germany, the Netherlands, Ireland, Switzerland, and the Nordic countries (including Denmark), as a rule, offer the highest pay to in-demand specialists.

These countries also have higher living costs. You earn more, you spend more, and you have less disposable income.

Countries where multinational companies offer attractive benefits are Portugal, Spain, and Greece.

They include financial bonuses, health benefits, insurance, gym memberships, meal vouchers, discounts, relocation packages, travel coverage, extra days off, and more.

But the salaries in these countries are lower because the cost of living is cheaper.

For example, the cost of living in Portugal is also considerably lower than in the Netherlands, so the salaries are adjusted accordingly.

Foreign language skills can increase your chances of getting a better-paying job. However, English is no longer considered an asset but a universal skill.

German continues to dominate as the most sought-after language internationally.

European companies are ready to pay up to 50% more to the job board to advertise German-speaking positions.

Nordic languages (Norwegian, Swedish, Finnish, Danish) are also in high demand.

Employers are willing to provide valuable benefits to speakers of in-demand languages, including visa sponsorship.

The most sought-after specialists have an in-demand language or several languages and expertise in one of the following fields: finance, marketing, sales, customer service, HR, administration, and IT.

The positions that require the knowledge of 2 or more languages come with better salaries and benefits. Plus, there's much less competition.

Data sources

- ECA's My Expatriate Market Pay Survey

- Emolument Salary Report

- GulfTalent Job Board

- Europe Language Jobs

- World Bank Income Data

- Dubai Salary Guide

- ContratorCalculator.co.uk

- CogsAgency.com

- U.S. Bureau of Labor Statistics

- Zippia.com

- Themuse.com

- SalaryExpert.com

- GritSerach.com

- www.michaelpage.com.sg

- www.efinancialcareers.sg

- En.moovijob.com

- https://dbdpost.com/top-highest-paying-jobs-in-saudi-arabia/

- https://brusselsmorning.com/what-are-the-highest-paying-jobs-in-denmark/23555/

You might find helpful:

- Discover The 20 Best Countries To Retire Abroad

- 5 European Destinations With Great Weather Throughout The Year

- The 13 Cheapest Countries To Retire To

- 12 Best Countries To Live In For Expats

- The Happiest Countries In The World

Secure Peace of Mind with Best-Value International Health Coverage

International Citizens Insurance provide free, no-obligation quotes from the leading international health insurance providers with plans tailored to meet your needs. Trusted by thousands of expats worldwide.